9+ pages depreciation by two methods sale of fixed asset 2.3mb solution in Google Sheet format. Depreciation by Two Methods. Fixed installment method is also known as straight line method original value method and original cost method. Accounting Q. Read also methods and depreciation by two methods sale of fixed asset The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each.

Select date and asset for the fixed asset depreciation. Example of Entries When Selling a Plant Asset.

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator

| Title: How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Doc |

| Number of Views: 8129+ times |

| Number of Pages: 8+ pages |

| Publication Date: August 2018 |

| Document Size: 1.7mb |

| Read How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator |

|

There are some differences in these cost allocation methods.

3- The profit or loss on sale will have to be calculated and posted to the corresponding credit or debit side of. 1- the cost of that asset needs to be taken out of the asset account. Journalize the entry to record the sale. Sale of Fixed Asset New lithographic equipment acquired at a cost of 562500 on March 1 of Year 1 beginning of the fiscal year has an estimated useful life of five years and an estimated residual value of 48400. Validate and post the fixed asset depreciation. There are two methods for accounting treatment.

Depreciation Formula Calculate Depreciation Expense

| Title: Depreciation Formula Calculate Depreciation Expense Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Google Sheet |

| Number of Views: 3200+ times |

| Number of Pages: 184+ pages |

| Publication Date: May 2020 |

| Document Size: 3.4mb |

| Read Depreciation Formula Calculate Depreciation Expense |

|

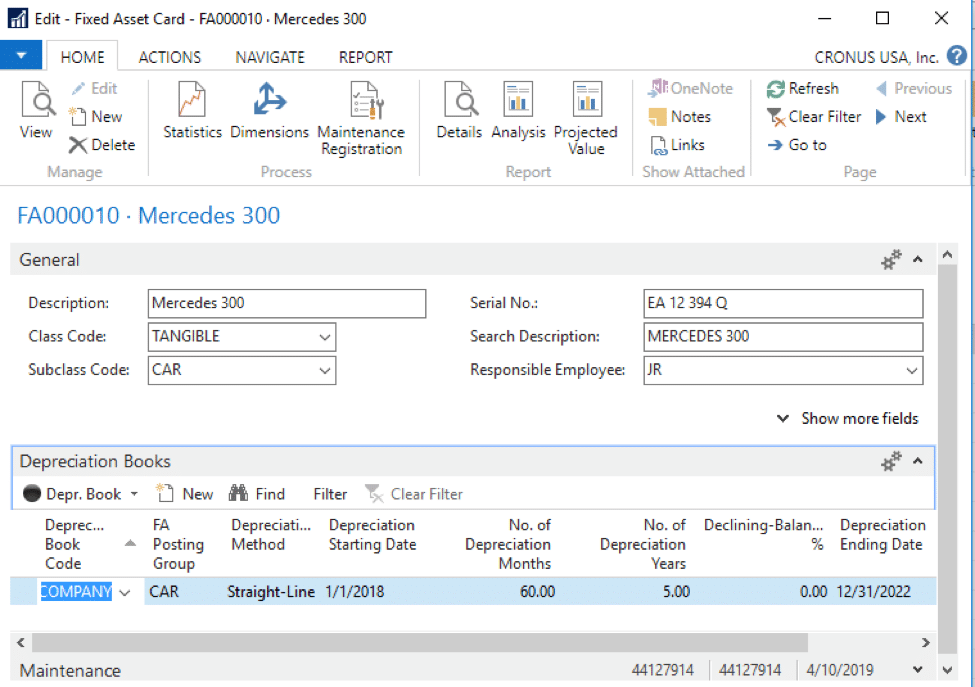

Fixed Asset Depreciation Options In Dynamics Nav Stoneridge Software

| Title: Fixed Asset Depreciation Options In Dynamics Nav Stoneridge Software Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Doc |

| Number of Views: 5164+ times |

| Number of Pages: 11+ pages |

| Publication Date: August 2019 |

| Document Size: 3mb |

| Read Fixed Asset Depreciation Options In Dynamics Nav Stoneridge Software |

|

Fixed Asset Depreciation Options In Dynamics Nav Stoneridge Software

| Title: Fixed Asset Depreciation Options In Dynamics Nav Stoneridge Software Depreciation By Two Methods Sale Of Fixed Asset |

| Format: PDF |

| Number of Views: 3240+ times |

| Number of Pages: 221+ pages |

| Publication Date: April 2021 |

| Document Size: 3mb |

| Read Fixed Asset Depreciation Options In Dynamics Nav Stoneridge Software |

|

4 Ways To Calculate Depreciation On Fixed Assets Wikihow

| Title: 4 Ways To Calculate Depreciation On Fixed Assets Wikihow Depreciation By Two Methods Sale Of Fixed Asset |

| Format: PDF |

| Number of Views: 7204+ times |

| Number of Pages: 95+ pages |

| Publication Date: June 2021 |

| Document Size: 2.3mb |

| Read 4 Ways To Calculate Depreciation On Fixed Assets Wikihow |

|

F A Fixed Assets

| Title: F A Fixed Assets Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Google Sheet |

| Number of Views: 8135+ times |

| Number of Pages: 55+ pages |

| Publication Date: May 2018 |

| Document Size: 725kb |

| Read F A Fixed Assets |

|

Definitions Depreciation In Fixed Assets The Moary Value Starts To Decreases Over Time Due To Use Wear And T Fixed Asset Marketing Trends Explained

| Title: Definitions Depreciation In Fixed Assets The Moary Value Starts To Decreases Over Time Due To Use Wear And T Fixed Asset Marketing Trends Explained Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Google Sheet |

| Number of Views: 9195+ times |

| Number of Pages: 297+ pages |

| Publication Date: May 2020 |

| Document Size: 2.8mb |

| Read Definitions Depreciation In Fixed Assets The Moary Value Starts To Decreases Over Time Due To Use Wear And T Fixed Asset Marketing Trends Explained |

|

Week 2 Accounting Basics Lesson 12 Depreciation Methods Accounting Basics Accounting Learning And Development

| Title: Week 2 Accounting Basics Lesson 12 Depreciation Methods Accounting Basics Accounting Learning And Development Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Google Sheet |

| Number of Views: 9176+ times |

| Number of Pages: 283+ pages |

| Publication Date: May 2021 |

| Document Size: 725kb |

| Read Week 2 Accounting Basics Lesson 12 Depreciation Methods Accounting Basics Accounting Learning And Development |

|

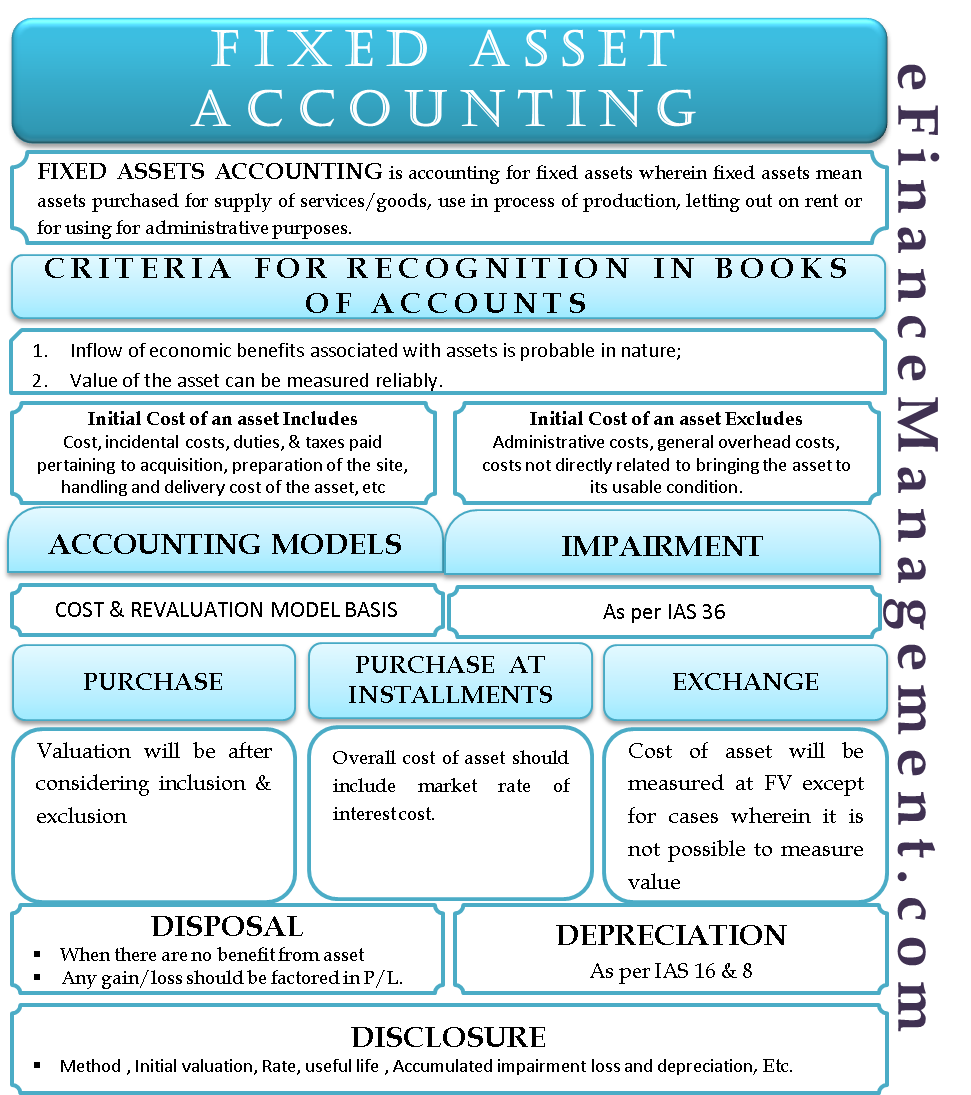

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

| Title: Fixed Asset Accounting Examples Journal Entries Dep Disclosure Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Google Sheet |

| Number of Views: 6201+ times |

| Number of Pages: 288+ pages |

| Publication Date: January 2021 |

| Document Size: 1.35mb |

| Read Fixed Asset Accounting Examples Journal Entries Dep Disclosure |

|

Property Plant Equipment Depreciation Methods Accounting Corner

| Title: Property Plant Equipment Depreciation Methods Accounting Corner Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Google Sheet |

| Number of Views: 3200+ times |

| Number of Pages: 81+ pages |

| Publication Date: January 2017 |

| Document Size: 1.2mb |

| Read Property Plant Equipment Depreciation Methods Accounting Corner |

|

F A Fixed Assets

| Title: F A Fixed Assets Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Google Sheet |

| Number of Views: 7148+ times |

| Number of Pages: 178+ pages |

| Publication Date: November 2018 |

| Document Size: 1.7mb |

| Read F A Fixed Assets |

|

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

| Title: Why Is Accumulated Depreciation A Credit Balance Depreciation By Two Methods Sale Of Fixed Asset |

| Format: Google Sheet |

| Number of Views: 3470+ times |

| Number of Pages: 283+ pages |

| Publication Date: August 2021 |

| Document Size: 6mb |

| Read Why Is Accumulated Depreciation A Credit Balance |

|

Print the fixed asset depreciation. The fixed assets cost and the updated accumulated depreciation must be removed. However the uniqueness of this method is that asset value is depreciated at twice the rate it is done in the straight-line method.

Here is all you need to learn about depreciation by two methods sale of fixed asset The manager requested Information regarding the effect of alternative methods on the amount of depreciation expense each year. Straight line depreciation is the easiest depreciation method to use. In the reducing balance method the depreciation is calculated by applying the depreciation rate and the depreciation amount keeps changing from time to time. How to calculate depreciation on fixed assets fixed asset economics lessons calculator f a fixed assets fixed asset depreciation options in dynamics nav stoneridge software 4 ways to calculate depreciation on fixed assets wikihow why is accumulated depreciation a credit balance week 2 accounting basics lesson 12 depreciation methods accounting basics accounting learning and development Journalize the entry to record the sale.